INTRODUCTION

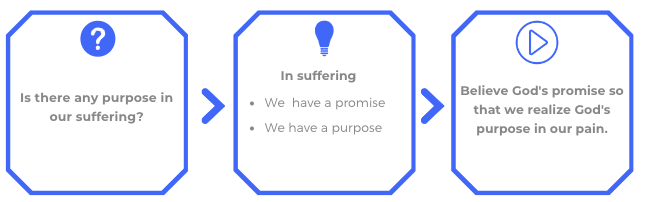

Our suffering is the greatest challenge to our faith in God’s purpose. There is no human experience that makes us question or doubt or even deny God’s purpose like our suffering. We can have 100% confidence in God’s purpose when things are going well, but then plummet to 0% confidence when suffering hits. “Why?” we protest at our pain. “What’s the point?” we complain when we lose a loved one. “Where are you God?” we yell, when family problems multiply. “Why is God doing this?” we object when we are victims of injustice. We cannot see any point, purpose, or profit in what we’re going through. Is there any purpose in our suffering? The Apostle Paul assures us that there is not only a purpose in our suffering, but we have a promise while we are suffering.

BACKGROUND

- Sermon 1: God’s purpose is is to glorify himself in grace-and-truth filled relationships.

- Sermon 2: Our first purpose is to glorify God in grace-and-truth filled relationships.

- Sermon 3: Our second purpose is to give God pleasure.

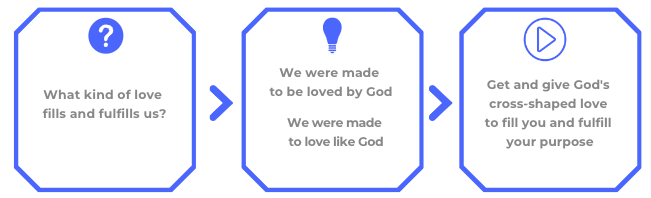

- Sermon 4: Our third purpose is to receive and return God’s love.

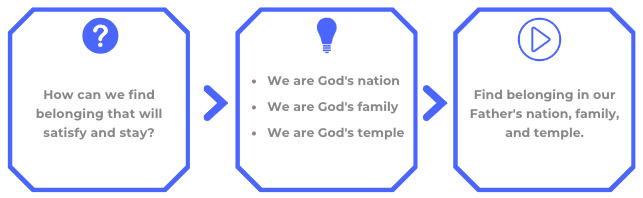

- Sermon 5: Our fourth purpose is to be part of God’s family

- Sermon 6: Our fifth purpose is to be like God’s Son.

Romans 8 begins with the role of the Spirit in the Christian life (1-17) and then moves on to the role of suffering in the Christian life (18-37). Romans 8:28-30 contains a promise for Christian sufferers (28), a purpose for Christian sufferers (29), and a prospect for Christian sufferers (30). I want to stress the word “Christian” here because the Apostle Paul makes it crystal clear that God’s promise and God’s purpose is only for God’s people. “We know that for those who love God all things work together for good, for those who are called according to his purpose” (28). God predestined them, called them, justified them, and will glorify them” (30).

What can I hold on to in suffering?

1. WE HAVE A PROMISE IN SUFFERING (28)

And we know that for those who love God all things work together for good, for those who are called according to his purpose (28).

Our All

This little 3-letter word is one of the biggest and hardest words in the whole Bible. It’s the biggest because nothing is excluded from “all” and everything is included in “all.” It’s easy to believe “some things” work together for our good, or “good things” or “most things” but “all things?” Yes, ALL things.

That means all bad things, all hard things, all painful things, all disappointing things, all sinful things, ALL things. Let’s get more specific: all pain, all loss, all death, all poverty, all temptation, all sin, all accidents, all evil, all injustice, all slander, ALL things. Let’s get even more specific: all cancer, all MS, all heart failure, all disability, all miscarriages, all “accidents,” all job losses, all business failures, all marriage conflict, all addiction, all teen rebellion, all mental illness, all abuse, all violence, all broken friendships, all betrayals. ALL things. “All things work together for good.”

This never makes any of these bad things, hard things, evil things, painful things into good things. None of these things are in any way good in themselves. They are all bad things. But God is promising that ALL bad work together for our good. That does not make God the author or the approver of the bad.

God’s Work

Good is not the automatic result of suffering. Neither is it the accidental effect of suffering. Neither is it something we work at. It is God who thoughtfully, skillfully, and powerfully mixes the worst of evils to produce the greatest of goods. He works all things together for good for all his people at all times and in all places.

What kinds of good does he make out of bad? Although the full good will not be revealed until heaven, some of the good we do see to some extent here on earth: deeper humility, increased prayer, deeper dependence, radical gentleness, passionate compassion, vigilant watchfulness, faster obedience, impressive witness, encouraged Christians, converted unbelievers, heavenly hope, etc.

CHANGING OUR STORIES WITH GOD’S STORY

Believe the promise. Sometimes we can see some good in the suffering or after the suffering, but no time do we see all the good. It takes faith to believe in the amount of good God works together for us in and through suffering. Not until we are in heaven will we see all the good God has worked out of the bad. As Mercy Me sing, “His heart beats for our good.”

Worship the Worker. This is one of the most incredibly awesome parts of God’s providential work in the world. He is working personal bad, national bad, world bad, into good for his people. He takes the worst of ingredients and makes the best of outcomes.

ALL GOOD

ALL FOR CHRISTIANS

FOR ALL CHRISTIANS

What is the greatest good God works from suffering? God’s greatest and best purpose in our suffering is Christ-likeness.

2. WE HAVE A PURPOSE IN SUFFERING (29)

For those whom he foreknew he also predestined to be conformed to the image of his Son, in order that he might be the firstborn among many brothers (29).

God’s pattern

God’s ultimate purpose and the greatest good in our suffering is likeness to Christ. God’s greatest purpose is not our comfort, our happiness, or our usefulness, but our Christ-likeness. Suffering is like God’s toolbox which he uses to remove un-Christlikeness and shape Christ-likeness. Every day, he looks at his heavenly Son, Jesus, then at each of his earthly sons and daughters and decides how to further shape them into looking like his heavenly Son. Jesus is his prototype, his pattern, his blueprint for each and all of his children.

Our prospect

Here is a beautiful prospect in the ugliest of times, a comforting end in the midst of pain, an enticing hope in despair: God’s working to make me like Jesus. I’m getting more and more like Jesus. I’m being sawed, chipped, sanded, and painted to look like, listen like, speak like, feel like, think like, trust like, love like Jesus.

And it’s not just individuals, God’s ultimate aim is that his Son one day is surrounded by so many different and varied people who are united in their perfect Christ-likeness. All his working is with that view that Jesus “might be the firstborn among many brothers” (29). It’s not that we will be clones of Jesus, like an army of identical people. No, this perfect Christlikeness will still preserve our unique humanity, character, personality, but beautifully perfected. We will not just be partially or occasionally like him, but will be completely and forever like him. Verse 30 calls it being “glorified” and we’ll look in more detail at this heavenly purpose in another sermon.

CHANGING OUR STORIES WITH GOD’S STORY

Cooperate with God’s purpose. Although this is God’s Work, he wants us to work with him in his great purpose, not against him. We can “waste” our suffering if instead of humbly submitting to it, we fight it, resent it, argue against it. It’s like sawing a piece of wood with a knot in it. The carpenter will take longer to cut through it and may even need a tougher saw. Be a knot-free piece of soft wood for maximum Christ-likeness.

Anticipate God’s purpose. Look ahead to the great end of all suffering – Christlikeness. We go through chemo, radiation, and surgery with varying hopes that the pain of the suffering will be worth it in the end, but that doesn’t always work out, does it? In this case, though, it will definitely work out. We can look ahead to this as a certain prospect. Look up to heaven and see there so many Christians already perfectly Christ-like in their souls, and soon to have visible expression in their bodies too.

WHEN YOU FEEL YOUR PAIN

HAVE FAITH IN GOD’S PURPOSE

SUMMARY

A NEW CHAPTER

Unbelievers. If you are not one of God’s children by faith in Jesus then not only are bad things working for your bad, but good things are working for your bad.

Believers. Use Scriptural examples of this to strengthen your faith in God’s good purpose: Joseph, Ruth, Job, Esther, David, Jonah, Peter, Paul, John, Jesus.

Children: John Piper taught the children in his congregation, this little saying: “When things don’t go the way they should, God always makes them turn for good.”

Prayer: Christ-Shaper, continue your good work of making me like Christ through good things and bad things by giving me faith in your promise and hope in your purpose.

DISCUSSION QUESTIONS

1. What suffering has made you question God’s purpose?

2. If this is a promise to God’s people, what can we say about suffering to unbelievers?

3. What’s the hardest part of the “ALL” things to believe any good can come of it?

4. What do these verses tell you about God?

5. How can you help or hinder the realization of God’s purpose in your life?

6. What examples can you give of these verses in your own or others’ suffering?

A NEW CHAPTER

A NEW CHAPTER